arizona solar tax credit 2022

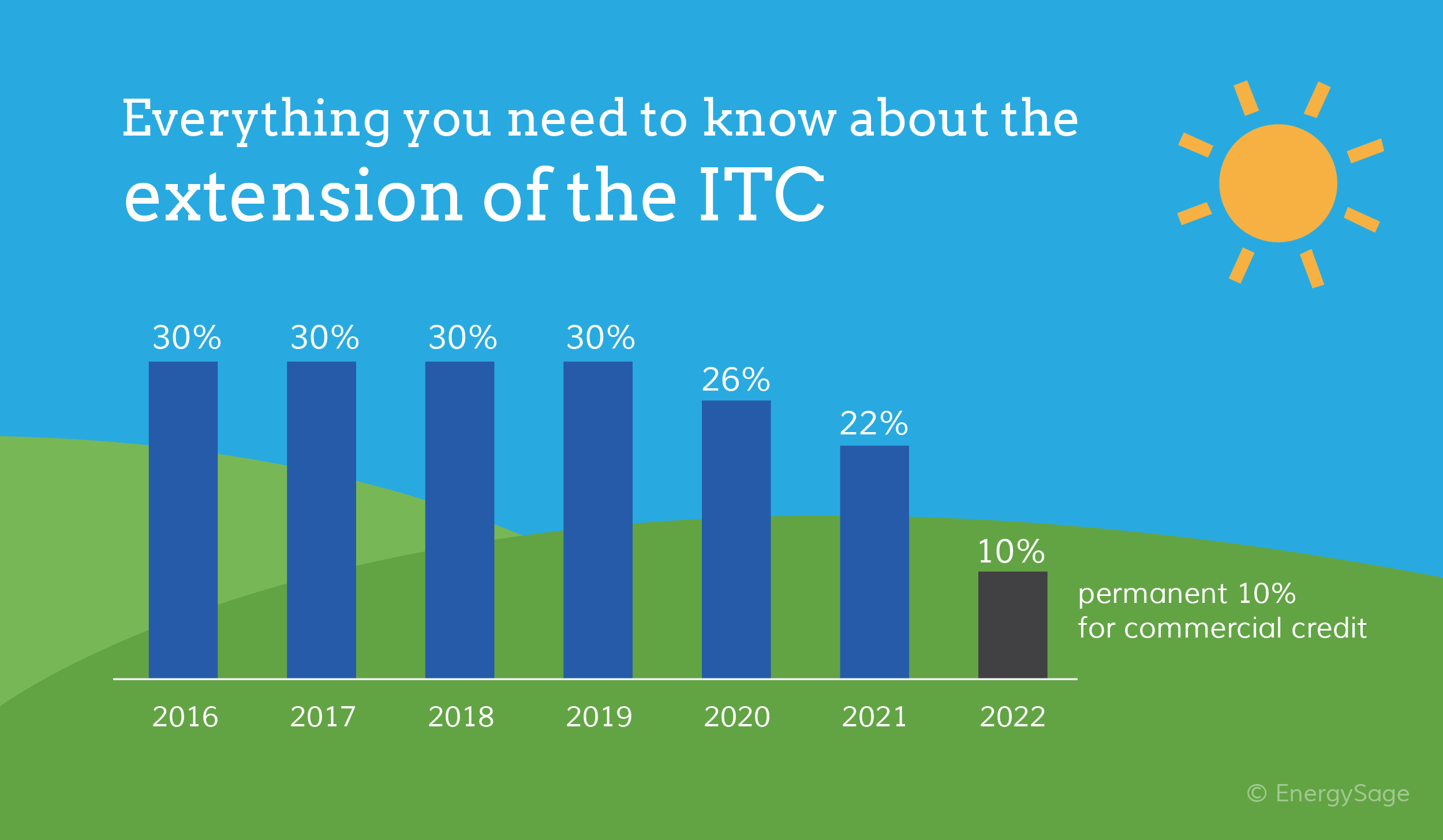

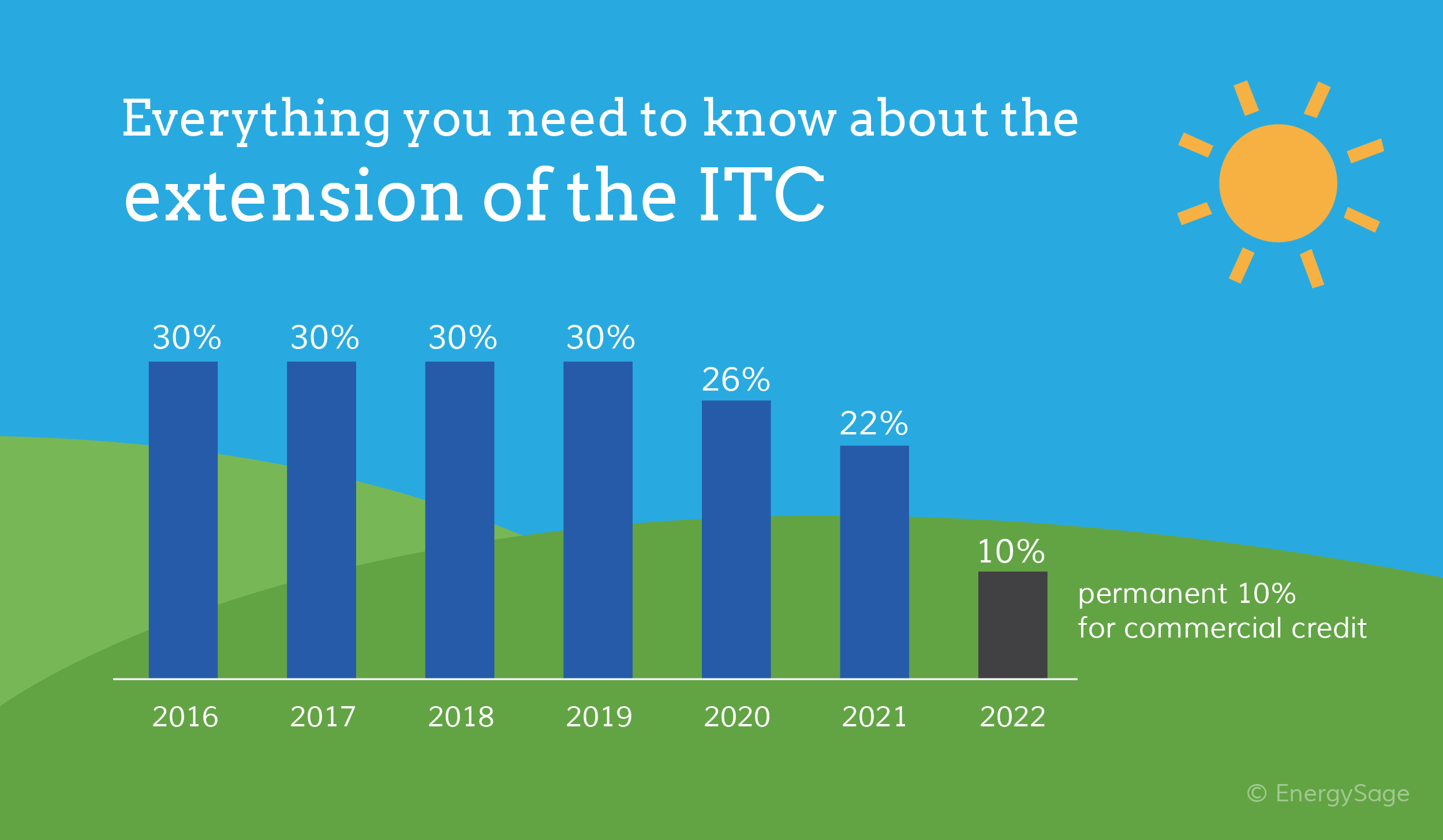

In December 2020 Congress passed an extension of the ITC which provides a 26 tax credit for systems installed in 2020-2022 and 22 for systems installed in 2023. This incentive is an Arizona personal tax credit.

Solar Tax Credit Pays For Solar Yuma Solar Pros 48solar

Ad United States residents set to get solar panels for no cost.

. The federal tax credit falls to 22 at the end of 2022. Ad United States residents set to get solar panels for no cost. 1000 Arizona Solar Tax.

The credit is allowed against. You pay a set monthly. An income tax credit is also available at the state level for homeowners in Arizona.

2022 is the last year for the full 26 credit. The renewable technologies eligible are Photovoltaics Solar Water Heating other Solar Electric Technologies. The solar investment tax credit is a dollar-for-dollar reduction in the amount of taxes you owe.

Low Cost Powerhome Solar Options for Less - Hire the Right Pro Today and Save. What Happens To A Solar LeaseSolar PPA After Death. Ad Step 1 - Enter ZipCode for the Best Powerhome Solar Pricing Now.

If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. The tax credit amount was 30 percent up to January 1 2020. Find The Best Option.

Program is limited to first 5000 applicants. Arizonas Energy Systems Tax Credit. Read User Reviews See Our 1 Pick.

Known as the Residential Solar and Wind Energy Systems Tax Credit. Heres the full solar Investment Tax Credit step. Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence.

Its no surprise that solar conversions in Arizona are generally. The 26 federal solar tax credit is available for purchased home solar systems installed by. Most Arizona residents are eligible to receive the Federal Solar Investment Tax Credit also called the Solar ITC.

The Arizona Commerce Authority ACA administers the Qualified Small Business Capital Investment program. Starting in 2023 the credit will drop to 22. The credit amount allowed against the taxpayers personal income tax is.

Ad A Comparison List Of Top Solar Power Companies Side By Side. Federal Solar Tax Credit. Solar Tax Credit Step Down Schedule.

In 2023 it drops down to 22 before ending permanently for homeowners beginning on January 1 2024. Renewable Energy Production Tax Credit. 2022s Top Solar Power Companies.

An individual or corporate income tax credit is available for taxpayers who own a qualified energy generator that first produces electricity before Jan. In the case of. Arizona is the sunniest state in the entire country with residents enjoying over 300 days of sunshine every year.

This benefit allows eligible homeowners to reduce the amount of tax they owe by. The 26 solar tax credit is available through the year 2022. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system.

The solar energy systems that qualify for a 26 tax credit must be placed into. The core differences between a solar lease and a Power Purchase Agreement PPA are simple. Program is limited to first 5000 applicants.

Provide any combination of the above by means of. Provide heating provide cooling produce electrical power produce mechanical power provide solar daylighting or. Arizona Residential Solar and Wind Energy Systems Tax Credit.

Income tax credits are equal to 30 or 35 of the investment amount. Regardless of where your solar panels are installed in the US you can claim a 26 federal solar tax credit on your next declaration.

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

Residential Energy Credit How It Works And How To Apply Marca

Information On Solar Energy Federal Tax Credits Northern Arizona Wind Sun

Solar Tax Credit In 2021 Southface Solar Electric Az

How Does The Federal Solar Tax Credit Work Freedom Solar

California Solar Incentives And Rebates Available In 2022

The Ultimate 2020 Guide To California Solar Tax Credit And Incentives

Pricing Incentives Guide To Solar Panels In Arizona Year Forbes Home

The Extended 26 Solar Tax Credit Critical Factors To Know

Arizona Solar Tax Credits And Incentives Guide 2022

7 California Solar Incentives You Need To Know In 2022 And Beyond Aurora Solar

Utah Solar Incentives Creative Energies Solar

/cdn.vox-cdn.com/uploads/chorus_asset/file/23298503/rsz_adobestock_166916488.jpg)

Federal Solar Tax Credit What Homeowners Need To Know This Old House

Federal Solar Tax Credit A Homeowner S Guide 2022 Updated

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

The Solar Investment Tax Credit In 2022 Southface Solar Az

Solar Tax Credit 2022 Incentives For Solar Panel Installations

2019 Pennsylvania Home Solar Incentives Rebates And Tax Credits Tax Credits Incentive Pennsylvania